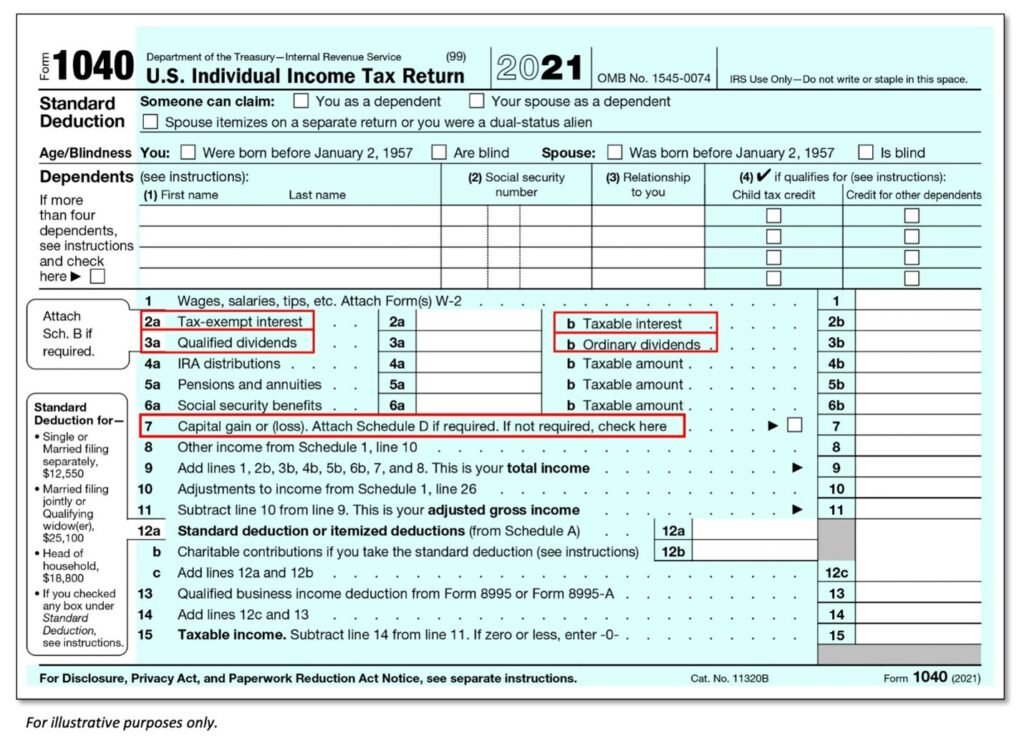

The IRS provides many tax forms for different purposes. Form 1040 is the main form for filing individual tax returns, while W-2 and W-4 handle employee wages and withholding. Freelancers use 1099-NEC, and business income is reported with Schedule C. There are also forms for credits, deductions, retirement, education, and amending returns like Form 1040-X.

Tax Return

File Tax Return Easily Today

Get Your Tax Return Filed Fast and Correct

Filing your tax return doesn’t need to be confusing or stressful. At SRS Financials, we provide fast, accurate, and reliable tax return services — whether it’s your federal, state, self-employed, or late tax return.

We don’t just push buttons — our team carefully reviews your documents and manually prepares your tax return to ensure everything is correct and complete. No costly mistakes. No missed deductions.

Filing your tax return doesn’t have to be stressful. Whether you need help with federal or state tax returns, late filings, or amendments, we handle everything manually to ensure accuracy. We support individuals, self-employed workers, and businesses in all 50 states — including California, Texas, Florida, and New York — with fast, reliable tax return services.

From W-2s to 1040s, we check every document and help maximize your refund through eligible tax credits and deductions. No confusing software — just expert help. Need proof of income for housing or loans? We’ve got you covered. Contact SRS Financials today to file your tax return the right way.

File Your Tax Return Easily and Correctly

What Is a Tax Return?

A tax return is a form submitted to the IRS or your state’s tax department that shows your income, deductions, and taxes owed or refunded. Filing your tax return helps you stay compliant with tax laws and get the refund you deserve.

Documents You Need to File a Tax Return

To prepare your return, you may need:

- W-2s or 1099s

- Tax ID Number (TIN)

- Proof of deductions or credits

- Previous income tax return (if amending)

We File All State and Federal Tax Returns

No matter where you live, we’ve got you covered:

- California Tax Return

- Texas Tax Return

- New York Tax Return

- Florida Tax Return

- And 46 other states…

Each state has its own rules. We help you file the right forms with the right numbers for your state.

Behind on Your Taxes or Need to Amend?

Missed a deadline? Made a mistake? We’ll help you file a late tax return or an amended tax return to correct any errors. Let us help you avoid penalties and get back on track.

Types of Forms in the IRS

Why Choose SRS Financials?

At SRS Financials, we make filing your tax return easy, fast, and error-free. Unlike online tools, we manually check every detail to avoid mistakes and make sure you get the maximum refund possible. Whether it’s a federal or state tax return, late filing, or amended return, our team offers expert, personalized help. We serve all 50 states and provide real support for income tax returns, self-employed taxes, and more. With SRS Financials, your tax return is filed right the first time — every time.

Stimulus Checks for Seniors in 2025: Eligibility and Key Updates

Many older adults wonder about extra cash from the government this year. Right now, on October 15, 2025, federal plans do not include broad stimulus checks aimed just at seniors. Past payments during tough times helped a lot, but those ended years ago. Instead, focus falls on regular benefit boosts like Social Security cost-of-living adjustments, which rose 2.5% for 2025. For eligibility, check state options—New York sends up to $400 inflation refunds to households earning under $150,000, and Virginia offers $200 rebates for filers with tax owed. Key updates show no IRS-wide program, but proposals like the American Worker Rebate Act float tariff relief up to $600 per person if passed. Seniors on SSI get max $967 monthly, up from last year, counting as steady aid. To stay ahead, file taxes early and watch state revenue sites. If you qualify for SSI or SSDI, automatic increases apply without extra steps. Rumors of $5,500 checks spread online, but officials call them false—stick to verified news. This setup helps pinpoint real support amid hype

Are Seniors Getting a Stimulus Check in 2025? What to Expect

Folks over 65 often ask if help is on the way. As of mid-October 2025, are seniors getting a stimulus check? The short answer points to no from the federal side. What to expect includes state-level breaks rather than nationwide deposits. For instance, Colorado’s TABOR refunds hit mailboxes this fall for those with 2024 tax liability. Expect nothing automatic like before—claim via tax forms if available. Social Security recipients see their checks grow with inflation, but that’s not a one-time boost. Watch for emails from state agencies if you filed recently. Debunked stories promise $2,000 deposits, yet IRS confirms zero plans. Plan budgets around known raises, and double-check local rules for rebates. This approach keeps surprises low

Will Senior Citizens Get a Stimulus Check in 2025? Federal vs. State Programs

Senior citizens face fixed costs, so questions about aid persist. Will senior citizens get a stimulus check in 2025? Federal efforts lean toward tax tweaks, not direct cash. State programs shine brighter—Alaska sends Permanent Fund dividends around $1,300 to residents, including elders. Compare: Federal focuses on credits like EITC expansions for low earners, while state ones target property taxes for over-65s in places like Pennsylvania. No uniform rollout exists, so outcomes vary by zip code. SSDI users qualify for state extras if income fits. Track bills in Congress for changes, but count on local filings for now. This split means checking both layers for full picture.

Will Seniors Get a Stimulus Check in 2025? Income Thresholds and Requirements

Uncertainty hits hard for retirees. Will seniors get a Stimulus check in 2025? Likely not federally, but income thresholds decide state aid. Requirements often cap at $75,000 for singles or $150,000 joint in rebate plans. Meet residency and filing status to snag New Mexico’s $500 gas rebates if under limits. No debts to IRS help too. For SSI folks, automatic hikes skip thresholds. Gather last year’s returns to test fits. Simple steps like updating addresses boost chances. This frame spots real paths forward.

Stimulus Checks for Seniors 2025: Low-Income and SSI/SSDI Recipients

Budget squeezes affect many elders. Stimulus checks for seniors 2025 target low-income groups most. SSI/SSDI recipients see federal maxes at $967 and steady disability flows, up slightly. States like California add $200 one-times for qualifiers under poverty lines. Low-income means under $14,580 yearly for one person, opening doors to extras. File Schedule 1 for credits if overlooked. Rumors of $5,108 ignore facts—opt for proven boosts. Pair with food aid for fuller relief. This mix eases daily loads.

IRS Stimulus Checks 2025 Tracker: Step-by-Step Guide

Tracking feels tricky without new funds. For any lingering IRS stimulus checks 2025, use tools wisely. This step-by-step guide starts at irs.gov—log in with ID.me for account views. Step 1: Enter SSN and filing details. Step 2: Check refund status under “View Your Account.” No app for old payments, but it flags errors. Step 3: Call 800-829-1040 if stuck. States like New York post trackers online. Keep docs handy. This path clears doubts fast.

Track My Stimulus Check 2025: Using the IRS Where’s My Refund Tool

Personal checks demand quick views. To track my stimulus check 2025, head to the IRS Where’s My Refund tool. Using it means inputting refund amount, filing date, and SSN post-April filing. Updates roll in 24 hours. For states, try their portals—Virginia shows rebates there. Mobile app works too. Spot issues early. This keeps you in loops.

Stimulus Check 2025 Update Today: Latest IRS Announcements

Fresh news shapes plans. Today’s stimulus check 2025 update from IRS notes no new rounds, just refund shifts to direct deposit only soon. Latest IRS announcements cover extension deadlines October 15. Check for credit claims. Seniors note COLA details. Stay tuned via emails.

Stimulus Check Update Today 2025: Debunking Rumors and Facts

Online buzz confuses. In this stimulus check update today 2025, debunking rumors tops the list—$1,390 deposits? Not real. Facts point to state rebates only. Verify via official sites. Avoid scam texts. Truth cuts through noise.

Stimulus Checks for 2025 Update: Timeline and Deadlines

Schedules matter for claims. The stimulus checks for 2025 update shows no timeline for federal—deadlines tie to 2024 filings by October 15. States like New York wrap refunds by year-end. Mark calendars for state notices. This sets clear bounds.

Stimulus Check 2025 Check Status Tracker: Online Tools and Tips

Status hunts need smarts. Grab a stimulus check 2025 check status tracker via online tools like IRS accounts. Tips: Use incognito mode, update bank info. For rebates, state apps shine—Colorado’s easy. Patience pays off.

Stimulus Checks 2025 Low Income: Qualifying for Maximum Benefits

Help reaches those in need. Stimulus checks 2025 low income folks aim for maximum benefits through credits up to $7,430 via EITC. Qualifying means under $63,398 joint with kids. States add layers—New Mexico for gas. File fully to max out.

Senior Stimulus Check Eligibility 2025: Age, Residency, and Filing Status

Rules define access. Senior stimulus check eligibility 2025 hinges on age 65+, residency in qualifying states, and filing status single or joint. Over-65 homeowners in Delaware get $1,750. Match criteria closely.

IRS Updates 2025 Stimulus Check: Tax Implications and Claiming Advice

Changes affect returns. IRS updates 2025 stimulus check stress tax implications—rebates often nontaxable. Claiming advice: Attach Schedule 8812 for families. E-file speeds it.

What Is Economic Relief for Affected Families 2025? Seniors Included

Aid forms vary. What is economic relief for affected families 2025 covers rebates and credits, with seniors included in pilots like Denver’s $725 monthly. Targets inflation hits.

When Do Stimulus Checks Come Out 2025? Expected Payment Dates

Dates guide waits. When do stimulus checks come out 2025? No federal set, but states like Alaska eye October. Expected payment dates follow filings.

How to Check Stimulus Check 2025: SSN and Direct Deposit Setup

Verification starts simple. How to check stimulus check 2025? Use SSN at IRS tool, ensure direct deposit setup for speed. Update via bank link.

Track My Stimulus Check by Social Security Number 2025: Secure Methods

Safety first in checks. Track my stimulus check by Social Security Number 2025 through official portals—secure methods like two-factor logins. Avoid third-party sites.

When Does Stimulus Checks Come Out 2025? Month-by-Month Schedule

Calendars help plan. When does stimulus checks come out 2025? Month-by-month schedule lacks federal entries; New York spans September-October. Eye locals.

Update on Stimulus Checks 2025: How It Affects Your Tax Return

Shifts impact forms. Latest update on stimulus checks 2025 shows how it affects your tax return—report rebates if taxable. Adjust withholdings now

Ready to File Your Tax Return?

Avoid costly delays or mistakes. Let SRS Financials handle your tax return with care and confidence.

👉 Contact us today to get started and also contact on Whatsapp