Introduction to California Pay Stub Abbreviations

What Are California Pay Stub Abbreviations?

California pay stub abbreviations are shorthand codes on a pay stub that detail your earnings, deductions, and payroll information. Common terms like YTD (Year-to-Date), FICA (Federal Insurance Contributions Act), or FIT (Federal Income Tax) reflect your gross pay, net pay, taxes, and deductions for a specific pay period. For instance, OASDI (Old-Age, Survivors, and Disability Insurance) covers Social Security and Medicare, while PTO represents paid time off. Understanding these California pay stub abbreviations is essential for employees to interpret their paychecks accurately, though many find them confusing.

Familiarity with California pay stub entries, such as regular pay, overtime pay, holiday pay, or retirement contributions, simplifies tracking your income. SRS Financials creates paystubs with clear California pay stub abbreviations to streamline payroll processes.

Why California Pay Stub Abbreviations Matter

California pay stub abbreviations are vital for both employees and businesses in managing payroll effectively. For employees, these codes clarify earnings and deductions, including federal and state taxes or flexible spending account contributions. Businesses rely on these payroll codes to ensure compliance with regulations and maintain accurate paycheck records.

Understanding California pay stub terms, like federal income tax withheld or child support deductions, helps employees avoid budgeting errors and supports sound financial planning. SRS Financials offers user-friendly tools to decode these abbreviations, ensuring paystub accuracy and transparency.

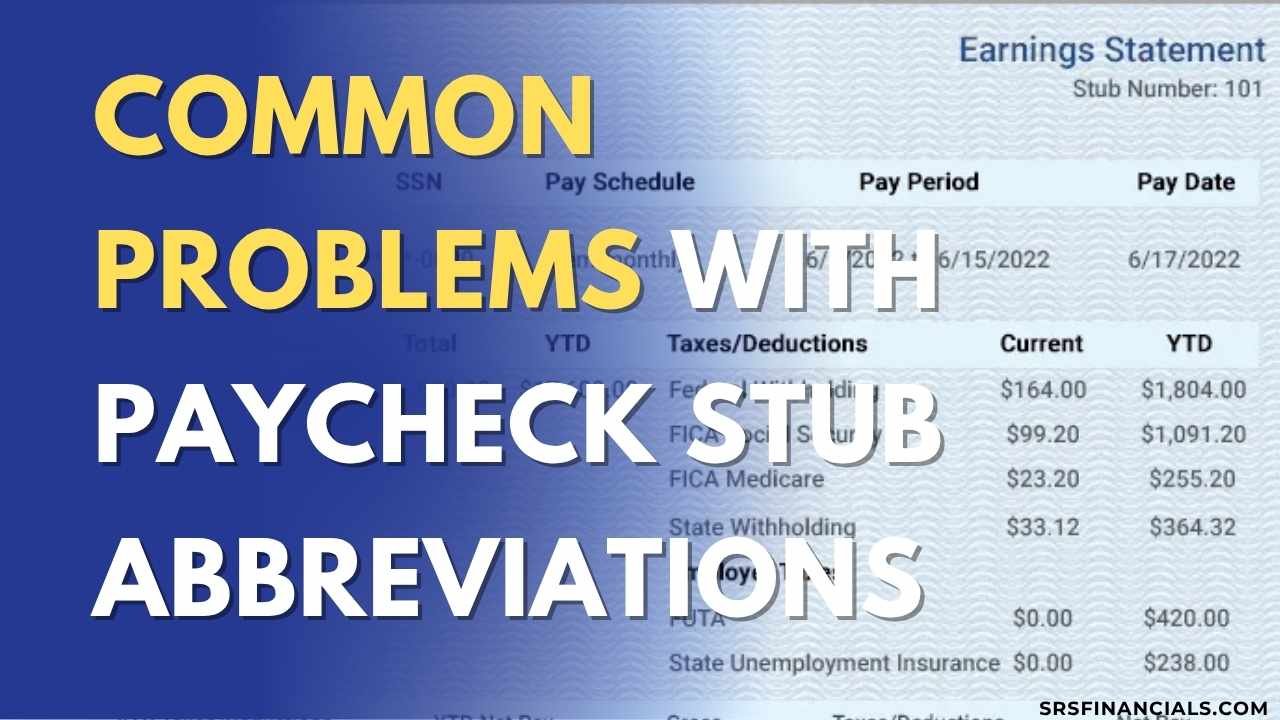

Common Problems with Paycheck Stub Abbreviations

Confusion from Complex Payroll Codes

Payroll codes on a paystub can baffle many employees. Codes like OASDI, FSA, or SW payroll might list deduction info for taxes and benefits, including disability insurance or health insurance premiums, without explanations. This complicates checking if take-home pay aligns with hours worked or regular hours. Misunderstanding paycheck stub abbreviations leads to mistakes in earnings section or total pay.

State-Specific Paycheck Stub Abbreviations Challenges

Paycheck stub abbreviations vary by state, notably in California. State income tax codes like SWT contrast with federal pay stub codes. Businesses require the correct payroll codes list to stay lawful. Employees might not understand paystub what is for local deduct items like garnishments or municipal taxes, affecting pay period amounts or current year earnings.

Lack of Clear Paystub Templates for Freelancers

Freelancers often miss a paycheck stub abbreviations template or paycheck stub abbreviations PDF. Without a payroll provider, making paystubs with clear pay stub abbreviation codes is difficult. This stops them from verifying earnings or tax deductions for loans or rentals. No available to employees templates with common abbreviations restricts income evidence.

Misinterpreting Tax-Related Abbreviations

Tax-related codes like FIT (federal income tax withheld) or FICA (federal insurance contributions act) puzzle employees. They might not know what is FIT on a pay stub or confuse OASDI (portion of FICA) with other withholdings. This leads to errors in W-4 form submissions or accurate tax filings, influencing year-to-date totals and budgeting and financial objectives.

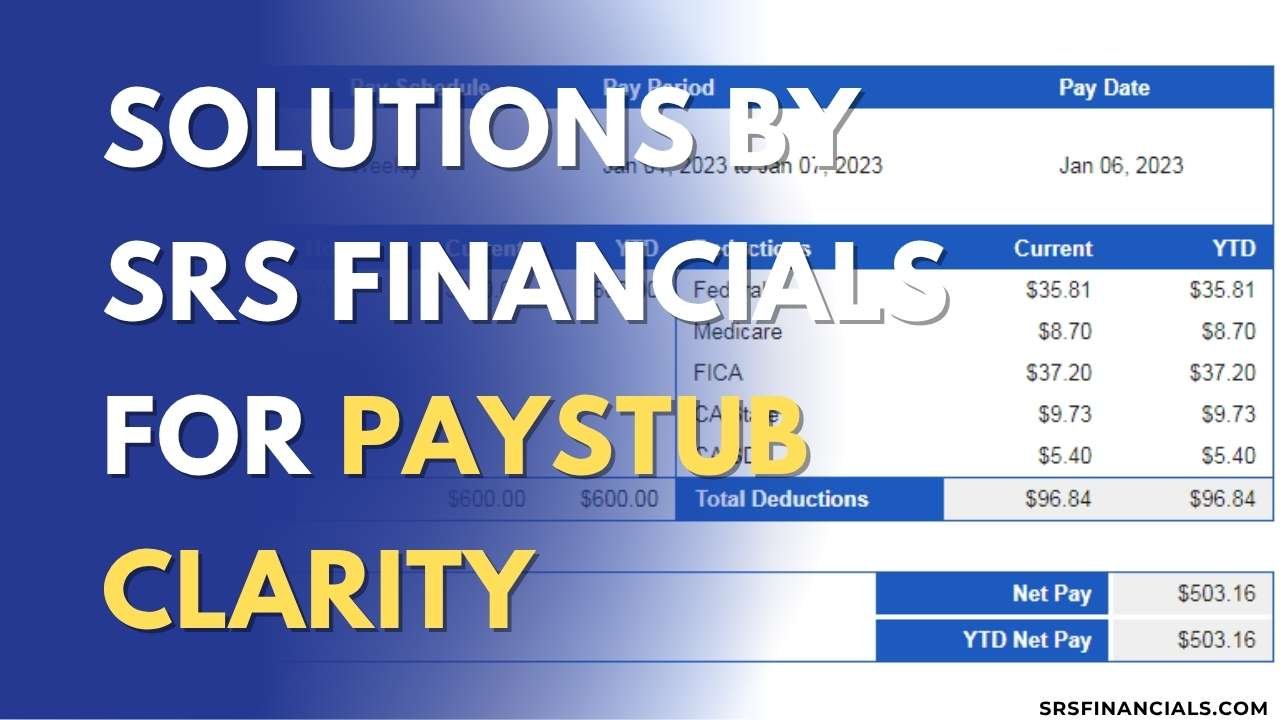

Solutions by SRS Financials for Paystub Clarity

Custom Paycheck Stub Templates and PDFs

SRS Financials offers paycheck stub abbreviations template and paycheck stub abbreviations PDF choices. Our paystubs include clear pay stub abbreviation codes for regular pay, overtime pay, holiday pay, and deductions like FSA or child support. These assist freelancers and employees in showing gross pay, net pay, and taxes and deductions for loans or rentals, simplifying paystub what is.

Accurate W2 and 1099 Form Services with Clear Codes

Our W-2 and 1099 forms apply precise payroll codes, such as FIT, OASDI, and state income tax. These support freelancers and employees with tax-related duties, like proving earnings or filing taxes. SRS Financials ensures every paycheck stub abbreviations is accurate to match federal taxes and state taxes guidelines.

Certified Payroll Management for All States

SRS Financials provides payroll services for businesses, addressing paycheck stub abbreviations California and federal pay stub codes. We manage payroll codes list elements like social security, disability insurance, and retirement plan contributions. This keeps many employees’ paystubs readable with earnings and deductions across states.

Paycheck Stub Abbreviations ADP-Compatible Solutions

Our paystubs integrate with paycheck stub abbreviations ADP systems, using standard payroll codes like PTO, FSA, or voluntary deductions. This allows businesses to include our paystub glossary in their payroll provider systems, maintaining clear pay period amounts and year-to-date totals.

Benefits of Using SRS Financials for Payroll Codes

Error-Free Paystub Documents with Clear Abbreviations

SRS Financials produces paystubs with accurate paycheck stub abbreviations. Every abbreviation on a pay stub, like YTD or FICA, gets checked to avoid errors. This keeps gross pay, net pay, and deductions like health insurance premiums or charitable donations right, boosting employees’ trust in paychecks.

Time-Saving Payroll Code Management

Our payroll services cut time by managing complex payroll codes. Businesses can grow while we handle earnings section, withholdings, and tax deductions. Employees receive paystubs showing number of hours, hourly wage, or additional pay, easing budgeting and financial tasks.

Improved Financial Clarity with Year-to-Date Totals

SRS Financials’ paystubs display year-to-date totals clearly, helping employees track earnings and deductions. Codes like YTD or social security and Medicare reflect the current year’s total. This aids budgeting and financial plans and simplifies taxes and benefits.

Support for Federal and California Pay Stub Codes

We focus on federal pay stub codes and paycheck stub abbreviations California. Our payroll services include state income tax, federal taxes, and garnishments, ensuring compliance. Employees and businesses get paystubs with clear pay stub abbreviation details for all needs.

Case Study: Simplifying Payroll with SRS Financials

Helping a California Business with Payroll Codes

A California company had trouble with paycheck stub abbreviations California codes like SWT and OASDI. Their paystubs listed payroll codes for state income tax and federal income tax withheld, yet many employees found paystub what is unclear. SRS Financials brought paychecks with simple pay stub abbreviation details, including earnings, deductions, and tax-related items like garnishments. This eased payroll tasks and helped employees track year-to-date totals.

Supporting Freelancers with Paystub Templates

A freelancer needed a paycheck stub abbreviations template to show earnings for a rental. Without a payroll provider, paystub what is stayed confusing on paystubs. SRS Financials offered a paycheck stub abbreviations PDF with pay stub abbreviation codes like FIT and FSA, displaying gross pay and net pay. This paystub glossary aided the freelancer in proving tax deductions and take-home pay for payroll services.

Why Choose SRS Financials for Paycheck Stub Services

Manual Calculations for Accurate Payroll Codes

SRS Financials applies manual checks for paycheck stub abbreviations, keeping payroll codes like OASDI, PTO, and retirement contributions precise. Paystubs show gross pay, net pay, and taxes and deductions without mistakes on paycheck data. This method supports employees and businesses needing reliable pay stub abbreviation info.

Fast Delivery and Affordable Paystub Solutions

SRS Financials sends paystubs within 24 hours at a low price. A paycheck stub abbreviations PDF or W-2 comes through payroll services at affordable rates. Employees, freelancers, and businesses receive quick paychecks with earnings and deductions across pay period amounts.

Trusted by Professionals for Paystub Glossary Needs

Skilled experts at SRS Financials build solid paystub glossary content. Paystubs feature common abbreviations like FICA, FIT, and YTD, relied on by professionals for tax-related and budgeting and financial work. This assists many employees and businesses with payroll codes.

FAQs About Paycheck Stub Abbreviations

What Must Be Included in a California Pay Stub to Meet California Paystub Requirements?

A California pay stub must include gross pay, net pay, earnings, deductions, pay period, pay period amounts, and year-to-date totals to meet paycheck stub abbreviations California rules. California labor code requires payroll codes like state income tax (SWT) and federal income tax withheld (FIT). California employees need number of hours worked, rate of pay, and social security details. Paystub abbreviations such as FICA and PTO align with California employment law, ensuring paychecks follow labor code section standards.

Is It Legal for Employees to Request Payroll Records in California?

Yes, employee in california can legally request payroll records under california labor code section. This helps california employees review paystubs and payroll codes, including pay stub or wage details. Paycheck stub abbreviations like OASDI and FSA become clear via paystub glossary. Law requires access to payroll taxes, tax deductions, and child support for budgeting and financial needs, supported by california department of records.

Are Employers Required to Follow Pay Stub Laws in California?

Yes, employers in california must follow california pay stub laws under california labor code. Payroll codes for federal taxes, state taxes, and social security and Medicare (FICA) must appear on paystubs. Earnings section details like overtime pay and additional pay need clarity. California employment law requires pay stub must show pay period and the corresponding data, with payroll services aiding employee pay stubs compliance.

How Can Pay Stub Errors Affect California Employment?

Pay stub errors under california’s wage and hour laws can disrupt california employment. Mistakes in paycheck stub abbreviations like FIT or YTD lead to wrong tax deductions or withholdings. California employees may face issues with take-home pay and pay period amounts. Errors in payroll codes like OASDI or flexible spending account impact effect during the pay period, affecting job stability.

What Are the Penalties for Violating Pay Stub Laws in California?

Penalties for employers violating california pay stub laws include fines if payroll codes on paychecks are missing. Violation of california labor laws occurs with pay stub violation penalties for absent paystub abbreviations like SWT or FICA. Deductions made on written orders for health insurance premiums or garnishments must be correct. California labor commissioner’s office enforces these pay stub must rules.

What Information Must Be Included on a California Pay Stub?

A california wage statement requires gross pay, net pay, hours worked, earnings, and taxes and deductions for paycheck stub abbreviations California. California law requires payroll codes like state income tax and federal insurance contributions act (FICA) for withholdings. Paystub abbreviations such as PTO and retirement account, plus child support, meet requirements that employers follow under california department of industrial relations.

Is It Legal to Request a Pay Stub in California?

Yes, it’s legal for employee in california to request a paystub under california state law requires employers rules. California employees can ask for paycheck stub abbreviations details like YTD and FIT to verify earnings and deductions. Paystub glossary access aids tax deductions and take-home pay, supporting wage claim with the california process for payroll services.

Are Employers Required to Follow Pay Stub Laws in California?

Yes, employer is required to follow california’s pay pay stub laws under california labor code. Payroll codes for federal taxes, state taxes, and social security (OASDI) are mandatory. Earnings like regular pay and overtime pay, plus deductions like FSA, help california employees track year-to-date totals. Require employers to provide pay stubs to employees as per state law.

Can I Get a Free California Pay Stub Template?

Yes, a free california pay stub template with paycheck stub abbreviations template is available via SRS Financials. This paystub includes pay stub abbreviation codes like FIT and YTD, showing gross pay and tax deductions. California employer and freelancers can use it for paychecks, with payroll codes for state income tax and retirement contributions per initial pay period needs.

What Are the Penalties for Pay Stub Violations in California?

Penalties for pay stub violations in state of california involve fines if payroll codes on paychecks are absent. Violation of california pay stub must rules occurs with paystub abbreviations like SWT or FICA errors. Deductions for child support or charitable donations must align with wage laws. California department enforces pay stub violation penalties affecting year-to-date totals.

Call to Action: Get Started with SRS Financials

Access Paycheck Stub Abbreviations Templates Today

Grab a paycheck stub abbreviations template or paycheck stub abbreviations PDF from SRS Financials. Our paystubs clarify pay stub abbreviation codes for employees and freelancers seeking payroll services.

Contact SRS Financials for Payroll Services

Call SRS Financials at +1-206-704-5757 or email srssolutionltd@gmail.com for payroll services. We supply paystubs and payroll codes for your paycheck stub abbreviations needs.