Introduction 1099 Contractor Pay Stubs

What Is an Independent Contractor Pay Stub?

An independent contractor pay stub is like a snapshot of what an independent contractor earns for a job or specific pay period. It’s not like the paycheck stub an employee gets from their employer. Instead, freelancers or self-employed folks make their own pay stub or use a service like a pay stub generator to show their gross pay, deductions and net pay. It lists things like client information, pay rate, year-to-date earnings and sometimes tax withholdings for stuff like state income taxes.

For 1099 contractors, this paystub is super handy to keep track of paystubs for 1099 independent contractors and show proof of income when applying for a loan or renting a place. It’s not the same as a 1099 pay stub tied to a 1099-MISC or 1099-NEC tax form, which the IRS uses, but it’s great for tax filing. Contractors create these to have accurate pay stub records for banks, landlords or audits, making sure their pay stubs show their accurate pay.

Employee vs. Independent Contractor

Knowing the difference between an employee and an independent contractor helps explain why pay stubs matter. Employees get a regular paycheck with a pay stub from their employer, showing payroll stuff like taxes tied to their Social Security number or benefits. But independent contractors are self-employed, working for clients, not bosses. They receive pay without automatic tax deductions, as independent contractors are responsible for handling their own tax withholdings.

Employees and contractors aren’t the same: employees stick to strict company rules, while independent contractors have more freedom. A 1099 contractor might use a 1099 pay stub or 1099 check stub to track earnings, but they don’t always receive a standard paycheck. This affects how pay stubs help freelancers and independent contractors with things like proof of income for loans or tax filing for their annual pay.

Do 1099 Employees Get Pay Stubs?

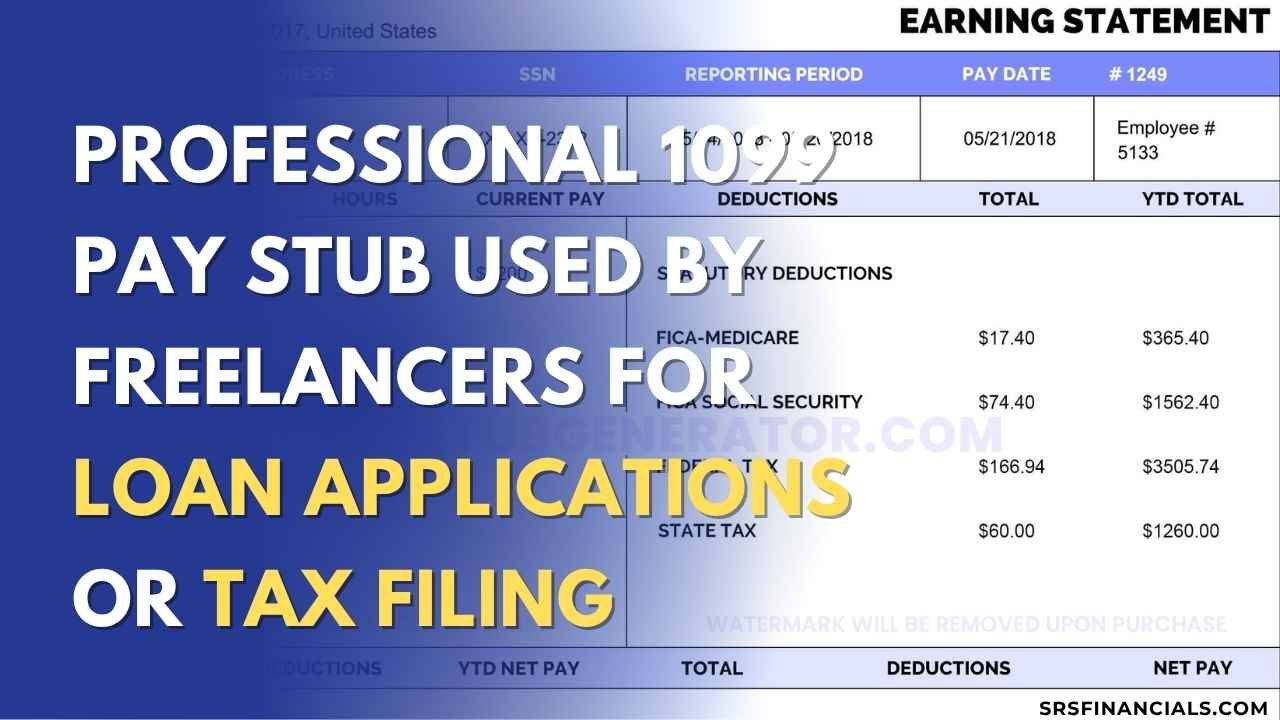

The term 1099 employees is a bit of a mix-up—it really means independent contractors. Unlike employees, who get paystubs through payroll, contractors don’t usually receive pay stubs from clients. Instead, they need to create pay stubs themselves or use an online pay stub generator. A pay stub for 1099 isn’t required but is super useful for keeping clear pay stub records for tax filing or to apply for a loan.

A 1099 pay stub shows earnings and deductions, just like a pay stub for contractors and can be used as proof of income for things like renting or financial applications. Contractors may generate a pay stub to track their annual pay or meet requests to get pay stubs for verification, making it easier to manage their pay period or project finances.

Do 1099 Employees Get Pay Stubs?

No, 1099 employees—a misnomer for independent contractors—don’t typically receive pay stubs from clients. Unlike employees, who get paystubs from payroll, independent contractors must create pay stubs themselves or use a pay stub generator. A pay stub for 1099 isn’t mandatory but helps independent contractors receive clear records for tax filing or to apply for a loan.

A 1099 pay stub shows earnings and deductions, like a pay stub for contractors and can be used as proof of income for rentals or financial applications. Contractors may generate a pay stub to track annual pay or meet requests to get pay stubs for verification.

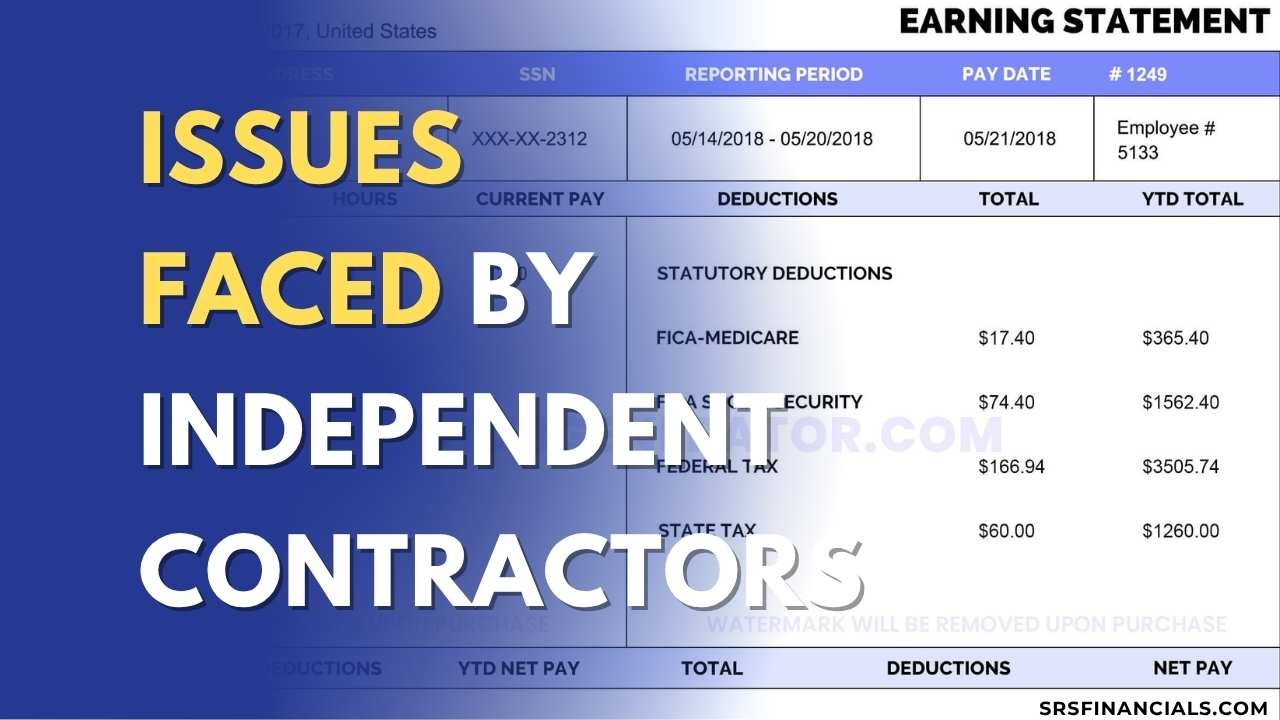

Issues Faced by Independent Contractors

Why Do Independent Contractors Need Pay Stubs?

Independent contractors need pay stubs to prove earnings for financial purposes. A pay stub for independent contractors acts as proof of income when applying for loans, renting apartments or securing mortgages. Freelancers and independent contractors often face requests to require proof of income and a 1099 pay stub fills this gap.

Pay stubs show gross pay, net pay and tax deductions, making them valuable for tax filing. Without a pay stub, contractors struggle to provide accurate pay stub records for banks or landlords. Pay stubs help track independent contractor pay stubs for personal records or audits, ensuring independent contractors are typically prepared for financial scrutiny.

Tracking Independent Contractor Pay Stubs

Tracking pay stubs is vital for independent contractors. A pay stub independent contractor uses organizes pay stub records to monitor earnings across multiple clients or projects. Pay stubs in minutes from a pay stub generator help contractors manage year-to-date totals and pay period details.

This practice supports business expense tracking and prepares freelancers for tax filing. Pay stubs help employers or clients verify payments, while independent contractors use them to maintain detailed pay stubs for consistency. Without tracking independent contractor pay stubs, contractors may lose track of annual pay or face issues during audits.

Tax Deductions for Independent Contractors

Unlike employees, who get their taxes sorted out by an employer, independent contractors have to deal with their own tax deductions. If you’re a 1099 independent contractor, you’re the one figuring out tax withholdings for stuff like state income taxes or federal taxes. These show up on an independent contractor pay stub, along with business expenses like your laptop or gas for work trips.

Freelancers and self-employed folks use pay stub templates to jot down these deductions neatly, which makes tax filing way less stressful. Mess up your pay stub records and you might miss out on deductions or get your tax withholdings wrong, which could mean a bigger tax bill. A pay stub for 1099 independent contractors keeps everything organized, showing earnings and deductions so you stay on the right side of the IRS with accurate pay.

What If Independent Contractors Don’t Receive a 1099 Form?

If independent contractors don’t receive a 1099-MISC or 1099-NEC tax form, they still have to tell the IRS about their earnings. Clients are supposed to send a 1099 for anything over $600, but independent contractors are responsible for keeping track of their gross pay. That’s where an independent contractor pay stub comes in handy—it’s like a backup to log your pay period or project earnings.

By using a pay stub generator, contractors can generate pay stubs to keep solid pay stub records and avoid headaches during tax filing. Without a 1099 pay stub or tax form, freelancers might find it tough to prove their income or deductions to the IRS, so a pay stub for 1099 is a lifesaver for staying organized.

.

SRS Financials’ Pay Stub Solutions

Generate Pay Stubs for 1099 Independent Contractors

SRS Financials helps independent contractors generate pay stubs for 1099 with precision. Unlike automated tools, our professional pay stubs are manually crafted to ensure accurate pay stub details. Freelancers can create pay stubs for any pay period or project, including year-to-date totals and tax deductions.

Our service supports 1099 contractors needing pay stubs for 1099 independent contractors to apply for a loan or rent. With contractor management in mind, SRS Financials delivers detailed pay stubs that align with IRS standards, helping contractors maintain pay stub records without relying on pay stubs without automation errors.

Independent Contractor Pay Stub Template

Our independent contractor pay stub template is designed for self-employed workers. It includes fields for client information, gross pay, net pay and deductions. Freelancers can customize this pay stub template to reflect earnings from multiple clients.

The template ensures pay stubs show all necessary details, like pay date and tax withholdings for proof of income. SRS Financials’ pay stub for 1099 independent contractors is tailored to meet financial verification needs, making it easy to create one for any pay period.

Independent Contractor Pay Stub Template Excel

SRS Financials offers an independent contractor pay stub template Excel for contractors who prefer spreadsheets. This template allows freelancers to input earnings, deductions and client information for a specific pay period.

The Excel format supports year-to-date tracking and tax deductions, ideal for self-employed workers. Contractors may use it to generate a pay stub that’s used as proof of income for loans or rentals, ensuring accurate pay and flexibility in contractor management.

Contractor Pay Stub Generator

Our contractor pay stub generator creates professional pay stubs for 1099 independent contractors. Unlike online tools, SRS Financials manually processes each paystub to ensure accuracy. Contractors can generate pay stubs with gross pay, net pay and tax deductions tailored to their pay period or project.

This tool helps freelancers get a pay stub for proof of income or tax filing, supporting contractors may need for financial applications. The pay stub generator delivers pay stubs in minutes with IRS-compliant details.

1099 Pay Stub Generator

The 1099 pay stub generator from SRS Financials is perfect for 1099 contractors. It creates 1099 pay stubs that include earnings, deductions and client information. Freelancers can generate 1099 paystubs for any pay date, ensuring accurate pay stub records. This service supports independent contractors receive detailed pay stubs for proof of income or tax filing, making it easy to create one for loans or audits.

QuickBooks 1099 Pay Stub

SRS Financials integrates with QuickBooks to produce QuickBooks 1099 pay stub documents. Contractors using QuickBooks can generate a pay stub with gross pay, net pay and tax withholdings. This pay stub for 1099 aligns with IRS standards, helping freelancers maintain pay stub records. It’s ideal for self-employed workers needing pay stubs help with tax filing or proof of income for financial applications.

Self Employed Pay Stub Template

Our self employed pay stub template is built for freelancers and 1099 independent contractors. It includes client information, earnings, deductions and pay date fields. Contractors can create pay stubs to track annual pay or require proof of income for loans.

The template ensures pay stubs show accurate pay and supports tax filing by listing tax deductions and year-to-date totals, perfect for self-employed record-keeping.

How to Generate a Pay Stub for 1099 Independent Contractors

To generate a pay stub with SRS Financials, independent contractors follow a simple process. First, provide client information and personal information, including Social Security number. Next, enter earnings for the pay period, such as gross pay or pay rate.

Add deductions like state income taxes or business expenses. Finally, review the paystub for accuracy and download it. This pay stub for 1099 independent contractors is used as proof of income for loans, rentals or tax filing, ensuring professional pay stubs in minutes.

Process of Generating an Independent Contractor Pay Stub

The process of generating an independent contractor pay stub starts with collecting client information and personal information. Contractors input gross pay, pay rate and year-to-date totals for the pay period.

SRS Financials calculates deductions and net pay manually to ensure accurate pay stub output. The stub summarizes earnings and deductions, creating a 1099 pay stub for tax filing or proof of income. This process helps freelancers get pay stubs that meet IRS standards and financial needs.

Elements of an Independent Contractor Pay Stub

An independent contractor pay stub includes key components: client information, personal information, gross pay, pay rate, deductions and net pay. It may list tax withholdings like state income taxes and year-to-date totals. The pay stub for 1099 also includes the pay date and pay period or project details.

These elements of an independent contractor ensure pay stubs help with proof of income or tax filing, making paystubs reliable for freelancers and 1099 contractors.

Client Information and Personal Information

Client information includes the payer’s name and contact details, while personal information covers the contractor’s name and Social Security number. These details on a 1099 pay stub ensure clarity for tax filing or proof of income. Independent contractors use this to generate pay stubs that are accurate pay records, helping freelancers maintain pay stub records for financial applications or IRS compliance.

Gross Income and Pay Rate

Gross income on a pay stub for 1099 shows total earnings before deductions. The pay rate details hourly or project-based pay for the pay period. Independent contractors use these figures to track annual pay and year-to-date totals. A 1099 pay stub with gross pay helps freelancers require proof of income for loans or rentals, ensuring pay stubs show accurate pay for financial clarity.

Deductions and Net Pay

Deductions on an independent contractor pay stub include tax deductions like state income taxes or business expenses. Net pay is the amount after deductions, reflecting what contractors take home. Pay stubs for 1099 independent contractors list these clearly, helping freelancers with tax filing or proof of income. SRS Financials ensures accurate pay stub details for IRS compliance and financial needs.

Value of SRS Financials Pay Stubs

Proof of Income for Loans and Rentals

A pay stub for 1099 is key for independent contractors to require proof of income for loans or rentals. Pay stubs show gross pay, net pay and deductions, making them reliable for banks or landlords. SRS Financials’ professional pay stubs help freelancers apply for a loan or secure housing, as paystubs for 1099 independent contractors are used as proof of income with accurate pay details.

Easier Tax Filing

Pay stubs for 1099 independent contractors simplify tax filing. They list earnings, tax deductions and year-to-date totals, helping freelancers prepare for IRS submissions. SRS Financials’ 1099 pay stub templates ensure accurate pay stub records, reducing errors in tax withholdings. Contractors can generate pay stubs to organize annual pay, making tax filing smoother and more efficient.

Legal Compliance and Audit Protection

SRS Financials’ pay stubs support 1099 contractors with IRS compliance. Detailed pay stubs include gross pay, deductions and net pay, protecting freelancers during audits. Pay stub records help independent contractors prove earnings and tax deductions, ensuring accurate pay documentation. This keeps contractors safe from penalties and supports contractor management.

Business Expense Tracking

Tracking independent contractor pay stubs aids business expense tracking. Pay stubs for 1099 list deductions like supplies or travel, helping freelancers monitor costs. SRS Financials’ pay stub templates organize earnings and deductions, supporting tax filing and financial planning. Contractors can generate a pay stub to maintain pay stub records for clear expense tracking.

Pay Stub for 1099 as Proof of Income

A pay stub for 1099 from SRS Financials is a reliable proof of income for independent contractors. It shows gross pay, net pay and pay period details, ideal for apply for a loan or rentals. Freelancers can get a pay stub that’s used as proof of income, ensuring accurate pay stub records for financial institutions or IRS needs.

Real-World Examples

How SRS Financials Helped a Freelancer with 1099 Pay Stubs

A freelancer needed a 1099 pay stub to apply for a loan. SRS Financials used our pay stub generator to create pay stubs with gross pay, deductions and net pay for a specific pay period. The pay stub for 1099 independent contractor included client information and year-to-date totals, helping the freelancer secure the loan. This accurate pay stub ensured proof of income and IRS compliance, showcasing SRS Financials’ professional pay stubs.

Contractor Management Success with Custom Paystubs

A global contractor managing multiple clients used SRS Financials’ 1099 pay stub templates for contractor management. We helped generate pay stubs for 1099 with earnings, tax deductions and pay date details.

The pay stubs in minutes supported proof of income for rentals and tax filing, streamlining pay stub records. This case shows how SRS Financials gives independent contractors reliable paystubs for financial clarity.

Reasons to Partner with SRS Financials

Manual Pay Stub Creation for Accuracy

SRS Financials creates professional pay stubs manually, ensuring accurate pay stub details. Unlike automated online pay stub generators, our pay stub generator avoids errors in gross pay, deductions or net pay. Independent contractors receive paystubs for 1099 independent contractors that meet IRS standards, perfect for tax filing or proof of income. This hands-on approach sets us apart for freelancers.

Certified Payroll Professional Assistance

Our certified payroll professionals assist 1099 contractors with pay stub creation. They ensure tax deductions, year-to-date totals and client information are correct.

Freelancers benefit from expert help to generate a pay stub that’s used as proof of income or for tax filing. SRS Financials’ expertise supports contractor management and IRS compliance.

Custom Templates and Document Packages

SRS Financials offers custom pay stub templates and document packages for 1099 independent contractors. Contractors can choose a pay stub for 1099 or independent contractor pay stub template Excel tailored to their needs. Packages include 1099 pay stub templates for proof of income or tax filing, helping freelancers create one with earnings and deductions for any pay period.

Secure Handling and Fast Delivery

SRS Financials prioritizes secure handling of personal information and client information. Our pay stub generator delivers pay stubs in minutes, ensuring independent contractors receive professional pay stubs quickly. Paystubs are safe for tax filing or proof of income, with fast delivery for freelancers needing pay stub records urgently.

Common Questions Answered

Can a 1099 Contractor Get a Pay Stub?

Yes, a 1099 contractor can get a pay stub using a pay stub generator like SRS Financials. While independent contractors don’t receive a standard paycheck, they can generate pay stubs to show earnings and deductions. These 1099 pay stubs are used as proof of income for loans or tax filing.

How Does the IRS Classify Someone as an Independent Contractor?

The IRS classifies an independent contractor based on control. Independent contractors have flexibility in work, unlike employees. They receive pay without payroll deductions and handle their own tax deductions. A 1099 pay stub helps contractors document earnings for tax filing or proof of income.

Are Businesses Required to Provide a 1099 Pay Stub?

No, businesses aren’t required to provide a 1099 pay stub. Independent contractors must create pay stubs themselves for proof of income or tax filing. A pay stub for 1099 can be generated using SRS Financials’ pay stub generator to meet financial or IRS needs.

How Do Independent Contractors Keep Track of Income and Expenses?

Independent contractors track income and expenses using pay stub records. A 1099 pay stub lists gross pay, deductions and net pay, helping freelancers monitor annual pay. SRS Financials’ pay stub templates simplify business expense tracking and tax filing for contractors.

What Information Is Included in a 1099 Pay Stub?

A 1099 pay stub includes client information, personal information, gross pay, pay rate, deductions, net pay and pay date. It may show year-to-date totals and tax withholdings. This pay stub for 1099 helps independent contractors with proof of income or tax filing.

When Do Businesses Need to Provide 1099-MISC Forms to Independent Contractors?

Businesses must provide a 1099-MISC or 1099-NEC tax form to independent contractors for payments over $600 annually. These form for independent contractors report earnings to the IRS. Contractors can use a 1099 pay stub to track pay period details if no tax form is issued.

How Does a 1099 Pay Stub Differ from a W-2 Pay Stub?

A 1099 pay stub is for independent contractors, showing gross pay and deductions without payroll withholdings. A W-2 pay stub is for employees, including tax withholdings like Social Security. Pay stubs for 1099 independent contractors are self-generated, while W-2 paystubs come from an employer.

Can I Add Deductions and Other Earnings to Contractor 1099 Pay Stubs?

Yes, contractors can add deductions and earnings to 1099 pay stubs. SRS Financials’ pay stub generator allows freelancers to include business expenses or tax deductions in a pay stub for 1099. This ensures pay stubs show accurate pay for tax filing or proof of income.

Can I Generate Pay Stubs for Previous Months?

Yes, independent contractors can generate pay stubs for past pay periods using SRS Financials’ pay stub generator. This helps freelancers create 1099 pay stubs for proof of income or tax filing, ensuring pay stub records are complete for any pay date.

Start Today with SRS Financials

Get Started with SRS Financials Pay Stub Services Today

Ready to create pay stubs for your 1099 independent contractor needs? SRS Financials offers professional pay stubs for proof of income, tax filing or contractor management. Use our pay stub generator to generate a pay stub with accurate pay details. Contact us at srssolutionltd@gmail.com or +1-206-704-5757 to get pay stubs today!