Introduction Florida Pay Stubs

Why Florida Pay Stubs Matter

Florida pay stubs are essential for Florida employees and contractors who need to prove income for financial transactions, such as securing apartments, loans, or insurance. A paystub details your earnings, tax deductions, and net pay, serving as a critical resource for verifying wage or salary. Whether you’re a new hire or a small business owner, accurate Florida pay stubs help you track payment history effortlessly.

Florida statutes, including the Fair Labor Standards Act (FLSA), outline requirements for paystubs, like including hourly rates and overtime. Inaccurate check stubs can lead to delays or rejections in employment or financial processes. SRS Financials delivers electronic Florida pay stubs that comply with these pay stub laws, ensuring timely, confidential, and reliable documents for all your payroll needs.

Challenges with Pay Stub Access in Florida

Getting a Florida paystub can be tough, especially for freelancers, contractors or small businesses not tied to systems like the Florida Accounting Information Resource. Many employees struggle to request pay stubs for employees due to lost login details or outdated passwords for platforms like the Information Center. Others face issues with payroll systems that don’t update regularly, leading to delays in accessing check stubs.

Florida employers may also find it hard to meet pay stub laws, risking non-compliance. Without proper resources, creating or accessing a paycheck that shows accurate tax and net pay details can feel overwhelming. SRS Financials solves these problems by offering a simple way to get paystubs that work for employment or financial needs.

Issues with Florida Pay Stubs

Lack of Access to Reliable Pay Stub Templates

Finding a good Florida pay stub template is a challenge for many. Users like freelancers or small business owners often rely on generic online tools that don’t follow Florida’s pay stub laws. These templates may miss key details like tax deductions, overtime or hourly rates, making them unusable for financial transactions or employment verification.

Some contractors need paystubs to show wage history for unemployment claims, but free tools often lack compliance with Florida statutes. Without a proper resource, you might end up with a check stub that doesn’t meet employer or lender standards. SRS Financials provides customized Florida pay stubs that are electronic, printable and built to match real payroll records.

Understanding Florida Pay Stub Laws

Florida pay stub laws, tied to Florida statutes and the Fair Labor Standards Act (FLSA), outline what a paystub must include, like employee’s name, wage, tax deductions and net pay. Employers to provide accurate paychecks must follow these requirements to avoid audit issues or penalties. Many Florida employers and contractors don’t fully understand these payroll laws, leading to errors in calculation or missing details like overtime.

For example, a paystub must clearly show earnings and deposit dates to meet compliance. Without legal advice or a reliable accounting system, creating a compliant Florida paycheck can be tricky. SRS Financials takes the guesswork out by manually crafting paystubs that follow Florida’s rules.

Time-Consuming Payroll Processes for Businesses

Small businesses in Florida often spend hours on payroll tasks like processing paychecks or calculating taxes. Unlike the Florida Accounting Information Resource, which serves state employees, private employers lack a centralized resource for pay stub creation.

Generating pay stubs for employees involves tracking hourly rates, overtime and deductions, which can delay payday. Business owners may struggle to calculate accurate net pay or meet pay stub laws, especially during new hire onboarding. This slows down financial operations and affects compliance. SRS Financials offers a streamlined payroll service to save time and produce accurate Florida pay stubs.

Errors in Automated Pay Stub Generators

Automated paystub generators often produce errors in calculation, like wrong tax rates or missing overtime details, which can fail an audit. These tools may not align with Florida pay stub requirements, causing issues for employees or contractors needing paystubs for insurance or loan applications.

For example, a Florida paycheck might show incorrect net pay or lack deposit details, making it unusable. Users without legal advice may not notice these mistakes until a lender rejects their check stub. SRS Financials avoids these problems with manual accounting to create error-free Florida paystubs.

SRS Financials’ Pay Stub Solutions

Custom Florida Pay Stubs for Employees and Freelancers

SRS Financials creates custom Florida pay stubs for employees and freelancers needing financial proof for loans, insurance or rent. Each paystub includes employee’s details, wage, tax deductions and net pay, matching Florida’s pay stub laws.

Whether you’re a contractor filing for unemployment or a new hire proving earnings, our electronic paychecks are built to look real and meet lender standards. Users can request a paystub with confidential handling, ensuring privacy. Our accounting team uses timely updates to keep your Florida paystub accurate and ready for any transaction.

Florida Pay Stubs Templates for Businesses

Our Florida pay stub templates help small businesses and Florida employers create professional paystubs for their employees. These electronic templates are easy to update and include tax, overtime and hourly details to meet pay stub laws. Business owners can calculate salary or wage accurately, ensuring compliance with Florida statutes.

Unlike the Florida Accounting Information Resource, our templates are accessible to all employers, not just state systems. Users can request custom designs to match their payroll needs, making financial record-keeping simple and timely.

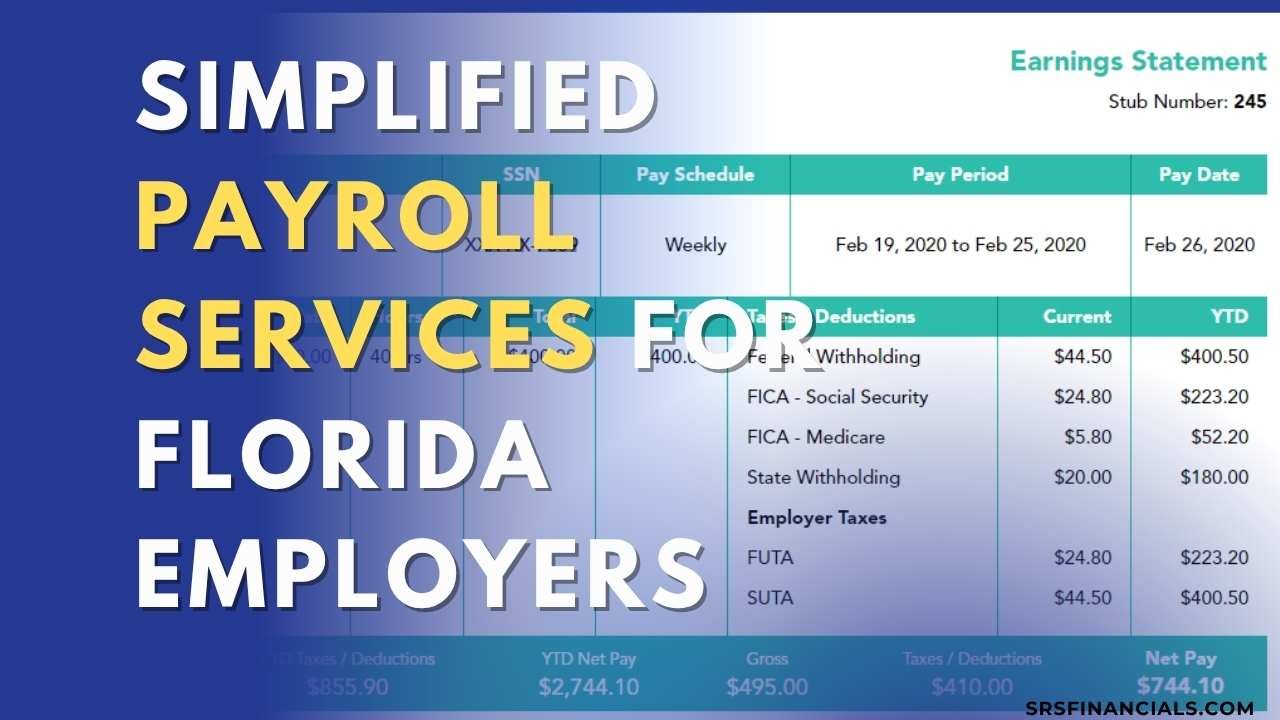

Simplified Payroll Services for Florida Employers

SRS Financials offers payroll services for Florida employers, handling processing, tax calculations and pay stub creation. We manage new hire onboarding, overtime and deductions, ensuring pay stubs for employees meet payroll laws.

Our accounting system tracks earnings and net pay, saving business owners time. Unlike state systems like the Information Center, our service is open to all employers, with no need for a login or password. We provide timely paychecks that align with payday schedules, keeping your small business compliant and efficient.

Compliance with Florida Pay Stub Laws

Every Florida paystub we create follows Florida’s pay stub laws and Fair Labor Standards Act (FLSA) requirements. We include employee’s details, tax deductions, overtime and net pay, ensuring compliance with Florida statutes.

Our accounting team checks each paycheck against payroll laws to avoid audit risks. Whether for employment verification or financial transactions, our paystubs meet state chief financial standards. Employers and contractors can trust SRS Financials for legal and accurate Florida pay stubs every time.

Fast and Secure Florida Pay Stub Delivery

Need a Florida paycheck quickly? SRS Financials delivers electronic paystubs in 24 hours, perfect for urgent transactions like loan or insurance applications. Our confidential process protects your employee or contractor data, with no need for an id and password.

Users can request their paystub via email or download it using Adobe Reader. We verify each check stub for accuracy, ensuring it meets Florida’s pay stub laws and employer needs, all while keeping your financial details secure.

Advantages and Success Story

Benefits of Choosing SRS Financials for Florida Pay Stubs

Accurate: Manual calculation ensures error-free paystubs with correct tax and net pay.

Compliant: Meets Florida pay stub requirements and payroll laws.

Customized: Templates match real paychecks for employment or financial use.

Fast: Timely delivery in 24 hours for urgent transactions.

Secure: Confidential handling protects employee and contractor data.

Affordable: Low-cost pay stubs for employees and employers, starting at $20.

Success Story: Helping a Florida Freelancer Secure a Loan

A Florida freelancer needed a paystub to verify income for a loan. Automated tools produced errors, missing tax and overtime details, causing rejections. SRS Financials created a custom Florida pay stub with accurate earnings, net pay and deposit dates, meeting Florida’s pay stub laws. The lender accepted the electronic check stub and the loan was approved in days, proving our resource works for financial transactions.

Reasons to Choose SRS Financials

Manual Preparation for Maximum Accuracy

Unlike automated calculators, our accounting team manually crafts each Florida paystub, checking tax, wage and overtime details. This ensures compliance with pay stub laws and avoids audit issues, making our paychecks reliable for employment or financial needs.

Trusted by Hundreds Across Florida

Hundreds of Florida employees, contractors and employers use SRS Financials for paystubs, tax forms and payroll services. Our timely updates and confidential handling make us a trusted resource for Florida’s financial needs.

Affordable Pricing for All Your Needs

Starting at $20, our Florida pay stubs are budget-friendly for small businesses, freelancers and employees. Get electronic paychecks that meet pay stub laws without breaking the balance.

Frequently Asked Questions

What details are needed to create a Florida paycheck?

You need employee’s name, wage or salary, tax deductions, overtime and net pay details. We also include payday and deposit dates to meet Florida pay stub requirements for financial transactions or employment verification.

How does SRS Financials ensure compliance with Florida payroll laws?

Our accounting team follows Florida statutes and the Fair Labor Standards Act (FLSA), including tax, hourly and overtime details in every paystub. We verify each check stub to avoid audit risks.

Can I get a paystub if I’m not part of the Florida Accounting Information Resource system?

Yes, unlike state systems like Information Center, SRS Financials serves freelancers, contractors and small businesses. No login or password is needed to request a Florida pay stub.

What is the difference between a paycheck and a paystub?

A paycheck is the payment you receive, while a paystub is a resource showing earnings, tax deductions and net pay. Both are key for Florida’s financial and employment records.

How can SRS Financials help with employment verification using paystubs?

Our Florida pay stubs include employee’s wage, tax and net pay details, perfect for verifying income with lenders, landlords or insurance providers, meeting pay stub laws.

Are there specific accounting requirements for Florida paystubs?

Yes, Florida statutes require paystubs to show employee’s earnings, tax deductions, overtime and net pay. Our accounting system ensures compliance with these pay stub laws.

How quickly can I receive a Florida paystub from SRS Financials?

We deliver electronic Florida pay stubs in 24 hours, ideal for urgent transactions like loans or insurance. Users can request via email and view with Adobe Reader.

What impacts net pay on a Florida paycheck?

Net pay is affected by tax deductions, hourly or salary rates, overtime and insurance contributions. Our calculator ensures accurate calculation for Florida paystubs.

Do SRS Financials’ paystubs meet Florida’s payday regulations?

Yes, our paystubs align with Florida’s payroll laws, including timely payment schedules and deposit details, ensuring compliance for employers and employees.

Can businesses use SRS Financials as a payroll resource for employees?

Our payroll services help Florida employers manage new hire paychecks, tax calculations and pay stubs for employees, keeping payroll timely and compliant.

Get Started with SRS Financials

Contact SRS Financials

Need a Florida pay stub? Call +1-206-704-5757 or email srssolutionltd@gmail.com to get accurate, confidential paystubs in 24 hours. Start your financial journey with SRS Financials!