At SRS Financials, we understand that managing taxes can be overwhelming. Whether you’re self-employed, a small business owner, or just need assistance with your IRS filings, we offer expert guidance to help you navigate the complexities of tax regulations. Let us handle your financial needs so you can focus on what truly matters. Contact us today for personalized services, including tax planning, IRS form filing, and more.

What is the 1040 ES Form

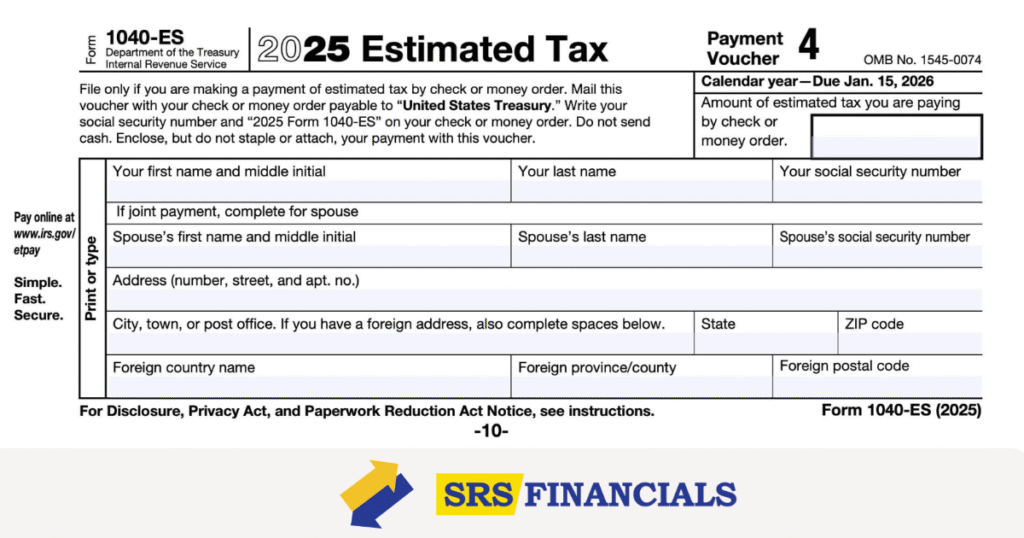

Filing taxes can often be a confusing task, especially for self-employed individuals and small business owners. One of the key forms for those who need to pay estimated taxes is the 1040 ES form. This form is designed for individuals who must pay quarterly estimated tax payments to the IRS, such as freelancers, contractors, and business owners.

The IRS 1040 ES form helps taxpayers calculate their estimated taxes based on their income. By using this form, you can avoid penalties for underpayment by paying your taxes in smaller installments throughout the year. For those unsure about how much to pay, this form comes with worksheets that guide you through the process.

For more details, check out our guide on the tax return in USA.

Why Do You Need to File IRS Form 1040 ES

The 1040 ES form serves a specific purpose: it ensures that people who don’t have tax automatically withheld, like freelancers or small business owners, are paying their taxes in increments. The IRS requires individuals who expect to owe more than $1,000 in taxes to make quarterly estimated tax payments.

Without proper filing, the IRS can impose penalties, and you might end up with a large tax bill at the end of the year. Filing the 1040 ES form allows you to stay on top of your tax payments, reducing the risk of surprises when it’s time to file your taxes.

How to Fill Out IRS Form 1040 ES

Filling out the 1040 ES form can seem intimidating, but it doesn’t have to be. The form comes with easy-to-follow instructions, and you can use a tax calculator to determine your estimated tax amount. The form requires basic information such as your income, deductions, and credits, as well as the amount of tax you have already paid.

There are four payment periods throughout the year, and you’ll need to estimate how much tax you owe for each quarter. The IRS provides an estimated tax worksheet to help you calculate your payment, which is crucial to ensure you pay the correct amount and avoid penalties.

Stay ahead on your taxes—let SRS Financials guide you in filling out IRS Form 1040-ES with ease and accuracy!

When and How to Pay Your Estimated Taxes

The IRS sets due dates for when you should submit your 1040 ES form payments, and these dates are spread throughout the year. For the current year, the due dates typically fall in April, June, September, and January of the following year. Make sure you follow these deadlines to avoid penalties for late payment.

There are several payment methods available. You can pay online using the IRS’s electronic payment system, or send a check with your 1040 ES payment voucher. Paying online is the quickest and easiest method, especially for self-employed individuals who are always on the go.

Common Mistakes to Avoid When Filing 1040 ES

When filing the 1040 ES form, many people make mistakes that can cost them. One common error is failing to file or pay the estimated taxes on time, resulting in penalties for late payment. Another mistake is underestimating the amount of taxes owed, which can lead to owing a large sum later on.

To avoid these mistakes, ensure that you calculate your estimated tax payments accurately. Use the IRS tools and worksheets, and if needed, consult a tax professional for guidance.

How to Calculate Your Estimated Tax Using IRS Form 1040 ES

The 1040 ES form requires you to estimate your tax liability for the entire year. To do this, you must account for your income, deductions, and credits, which can be a little tricky. For instance, if you’re a freelancer, you may need to consider your business expenses, health insurance premiums, and other deductions that could affect the amount you owe.

Once you’ve calculated your income and deductions, you can determine your estimated tax payments. The IRS provides tax calculators that can assist you in determining how much you owe for each quarter.

Explore the latest tax brackets and rates for individuals and businesses in the USA

What Happens if You Miss the IRS 1040 ES Deadline

Missing the 1040 ES form deadline can lead to penalties and interest charges. If you don’t pay your taxes on time, the IRS may charge you a penalty for late payment, which can add up quickly. The penalty amount depends on how late you are and how much you owe.

If you miss a payment, you can still make it up later by submitting a payment along with your next quarterly 1040 ES form. However, it’s always best to stay on track with your payments to avoid additional charges.

personal experience

As a self-employed individual, filing the 1040-ES form was initially overwhelming. I struggled with calculating estimated taxes and understanding the IRS guidelines. However, working with SRS Financials made the process much easier. Their expertise helped me file accurately and on time, taking away the stress of tax season. I highly recommend their services to anyone needing help with tax planning and filings.

Conclusion

Understanding and filing the 1040 ES form is an important responsibility for those who are self-employed or have income that is not subject to automatic withholding. By filing your estimated taxes on time and calculating them accurately, you can avoid penalties and keep your finances in good shape.

At SRS Financials, we offer comprehensive financial services, including assistance with tax filings and planning. Our expert team is here to help you navigate the complexities of filing your 1040 ES form and ensure that you stay compliant with IRS requirements.

Don’t miss our post on imputed pay.

Frequently Asked Questions - 1040 ES Form

What is the 1040 ES form used for?

The 1040 ES form is used by individuals to make estimated tax payments to the IRS. It’s primarily for those who don’t have taxes automatically withheld from their income.

Who needs to file the 1040 ES form?

Self-employed individuals, freelancers, and small business owners who expect to owe more than $1,000 in taxes should file the 1040 ES form.

What happens if I miss the deadline for IRS Form 1040 ES?

If you miss the 1040 ES form deadline, the IRS will charge you a penalty for late payment. It’s important to make payments on time to avoid these penalties.

How can I pay my estimated tax payments?

You can pay your 1040 ES form payments online using the IRS payment system or by mailing a check with your payment voucher.

Can I get help with filing my 1040 ES form?

Yes, at SRS Financials, we offer expert assistance with filing your 1040 ES form and ensuring your estimated taxes are calculated correctly.