Instant Paystubs for Proof of Income

Get instant, accurate, and professional paystubs for fast and reliable proof of income—perfect for loans, housing, insurance, and more.

What Are Paystubs?

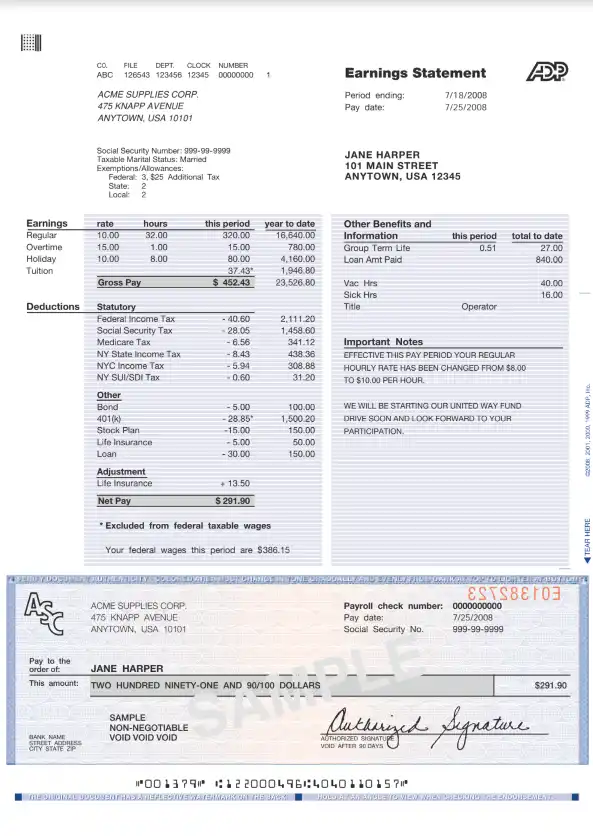

A paystub, also known as a paycheck stub or payroll stub, is a document that shows the details of an employee’s earnings, deductions, and net pay over a specific pay period. It is essential for proof of income, tax filing, loan applications, rentals, and many other financial needs.

Whether you’re a freelancer, gig worker, contractor, or small business owner, having access to accurate and professional paystubs is vital in today’s economy.

What Are Paystubs Used For?

Paystubs are commonly used for:

- Income verification for loans, credit, or mortgages

- Providing proof of employment or self-employment

- Renting an apartment or leasing a property

- Tax filing and deduction tracking

- Applying for healthcare, insurance, or financial aid

If you’re self-employed or working without traditional payroll, it can be hard to show reliable income. That’s where we help.

Who Needs A Pay Stub?

Employees:

Employees need paystubs for things like proof of income, income verification, and tax filing. If the W2 form is missing or delayed, a paystub can help show the same income details.

Some Company verify the paystubs through employers and then procced to application.

Employers:

Employers need to keep paystubs to show how much was paid to each employee. This helps the HR department and avoids problems if someone says they weren’t paid right.

Having payroll records is a smart way to stay clear and safe in business.

Entrepreneurs:

Freelancers, contractors, and entrepreneurs need paystubs to show their proof of income. Their income may change, so it’s important to keep track of earnings and deductions.

This helps them stay ready for tax filing and other money matters.

Why Choose SRS Financials for Your Paystubs?

At SRS Financials, we specialize in custom paystub creation that looks professional and accurate — tailored to your income situation.

Here’s what makes our service the best:

Manual Calculation for Accuracy

We don’t rely on automated calculators only — our experts manually calculate taxes and deductions to ensure accuracy and avoid costly mistakes or penalties.

Legit, Company-Branded Templates

Choose from multiple professional templates that resemble real company-issued stubs. These look clean, detailed, and authentic.

Tailored for All Types of Workers

From freelancers and contractors to employees and small business owners, our paystubs are flexible and customized to your income type and frequency.

Fast Turnaround

Get your custom paystub within hours — ideal for urgent loan or rental needs.

Secure & Confidential

Your data stays safe. We never share your information and operate with strict privacy practices

Types of Paystubs We Offer:

- Hourly or salary-based paystubs

- Weekly, biweekly, or monthly formats

- With or without employer info

- With direct deposit details

- State-specific paystub formats

- Contractor or 1099-style income stubs

- Paystubs with year-to-date (YTD) earnings

Ideal For:

- Loan and mortgage applications

- Proof of income for rentals

- Healthcare and government applications

- Employment verification letters

- Tax documentation

- Self-employed or freelance workers

100% Satisfaction Guaranteed

We ensure your paystubs look legit, read correctly, and serve your purpose — whether it’s applying for a loan, proving income to a landlord, or verifying employment.

What Does YTD Mean on a Check? Simple Breakdown for Beginners

New to reading your paycheck? What does YTD mean on a check often puzzles folks starting out. YTD shows year to date totals, summing up earnings and cuts from January 1 to now. Spot it near the bottom, listing gross pay, taxes pulled, and net cash. For beginners, think of it as a running score—your YTD gross pay climbs with each pay cycle, helping banks or landlords see steady income. A weekly check might show $500 that period plus $15,000 YTD, proving reliability. Taxes like federal withholding add up too in YTD deductions. Miss a stub? Services recreate accurate ones with full YTD details for loans or rentals. This simple breakdown clears confusion fast—check yours next payday.

What Is YTD in Payroll? How It Tracks Your Earnings

Payroll pros handle numbers daily. What is YTD in payroll? It stands for year-to-date figures that tracks all earnings over 12 months. Employers use it to report totals to IRS via W-2s at year-end. How does it tracks? Software or manual logs add each period’s wages, bonuses, overtime into one pot. Your YTD on stubs verifies compliance and aids audits. Freelancers recreate stubs to show YTD earnings for gigs. States require precise YTD for unemployment claims. This setup keeps records straight year-round.

What Does YTD Mean on a Payslip? Earnings and Deductions Explained

Stubs pack info. What does YTD mean on a payslip? It means cumulative earnings minus deductions from start of year. Earnings include base pay, tips, commissions tallied YTD. Deductions cover FICA, health premiums, 401(k) contributions stacked up. A mid-year payslip might list $30,000 gross YTD against $5,000 withheld, netting $25,000. Explains why totals grow monthly. Lost yours? Custom services build legit ones with exact YTD math for verifications. Ties to tax prep too—YTD feeds W-2 accuracy.

What Does YTD Stand For? Full Definition and Common Uses

Acronyms pop up everywhere. What does YTD stand for? Year To Date, the full definition covers sums from January through current date. Common uses span payroll stubs, financial reports, investment statements. In checks, tracks wages; in stocks, performance since New Year. Businesses rely on it for budgeting, employees for proof. Services generate stubs highlighting YTD for rentals or jobs. Simple yet vital across fields.

What Does YTD Amount Mean? Reading Totals on Your Stub

Numbers confuse at first. What does YTD amount mean? It means the total accumulated value YTD shown on your stub. Reading it involves scanning lines for gross, taxes, net YTD. High YTD amount signals strong income history. Lenders love it for approvals. Recreate missing stubs to display clear YTD amounts. Makes verification smooth.

What Does Gross Pay YTD Mean? Total Wages Before Taxes

Wage lines stand out. What does gross pay YTD mean? Total wages earned YTD before taxes or cuts. Includes salary, hours, extras without subtractions. By December, matches W-2 box 1. Helps calculate bonuses or raises. Services craft stubs with precise gross pay YTD for self-employed proofs. Key for full picture.

What Is YTD on a Paycheck? Year-to-Date Tracking Basics

Paychecks reveal patterns. What is YTD on a paycheck? Year-to-date tracking basics sum income and holds from year start. Shows progress toward annual goals. Basics include adding each period’s figures. Vital for tax planning. Generate custom paychecks with YTD for freelancers.

Year to Date Meaning on Check: Cumulative Income Guide

Checks hold clues. Year to date meaning on check points to cumulative income since January. Guide says add all prior pays for true total. Proves stability for credits. Services provide cumulative views via recreated checks.

What Does Year to Date Mean on a Paycheck? Step-by-Step

Break it down. What does year to date mean on a paycheck? Step-by-step, start with January pay, add February, through now. Covers gross, nets, hours. Tracks taxes owed. Step-by-step recreation ensures accuracy for needs.

Meaning of YTD in Salary Slip: Key Payroll Terms

Slips use shorthand. Meaning of YTD in salary slip ties to yearly sums. Key payroll terms like gross YTD, deductions explain flows. Essential for reviews.

What Does YTD on a Check Mean? Quick Reference

Fast facts help. What does YTD on a check mean? Yearly running total. Quick reference: Scan for earnings buildup. Aids quick proofs.

YTD Full Form in Payslip: Year-to-Date Explained

Forms clarify. YTD full form in payslip is Year-to-Date. Explained as calendar-year accumulator on stubs.

What Does YTD Net Pay Mean? Take-Home After Deductions

Bottom line matters. What does YTD net pay mean? Take-home cash after deductions YTD. Shows real spendable total.

Is Year to Date Gross or Net? Understanding the Difference

Debate settles. Is year to date gross or net? Gross before cuts, net after. Difference affects proofs—use gross for income, net for budgets.

What Is Year to Date Take Home? Your Actual Earnings

Real cash counts. What is year to date take home? Your actual earnings post-taxes YTD. Tracks pocket money.

What Does YTD Mean on a Pay Stub? Visual Examples

Stubs illustrate. What does YTD mean on a pay stub? Yearly totals with visual examples like charts of rising lines.

What Does YTD Deductions Mean? Taxes and Withholdings YTD

Cuts add up. What does YTD deductions mean? Taxes and withholdings YTD totaled for compliance.

Gross Year to Date Meaning: Total Income So Far

Big picture. Gross year to date meaning is total income so far pre-cuts.

What Does Gross YTD Mean? Before-Tax Wages Defined

Defined clearly. What does gross YTD mean? Before-tax wages summed yearly.

YTD Full Form in Finance: Broader Applications

Finance expands. YTD full form in finance applies to returns, not just pay.

What Does Pay Period YTD Mean? Period vs. Annual Totals

Compare scales. What does pay period YTD mean? Single period added to annual totals.

What Is YTD Gross Pay? Calculating Your Yearly Wages

Math time. What is YTD gross pay? Calculating sums for yearly wages.

What Does Net Pay YTD Mean? Final Take-Home Figures

End result. What does net pay YTD mean? Final take-home figures yearly.

Year to Date Take Home Meaning: Real Money in Pocket

Pocket impact. Year to date take home meaning is real money in pocket after all.

What Does YTD Hours Mean? Tracking Work Time YTD

Time logs. What does YTD hours mean? Tracking work time YTD for overtime.

What Is Interest Paid YTD? Earnings on Savings or Loans

Side gains. What is interest paid YTD? Earnings on savings or loans accumulated.

Wages Earned Year to Date Meaning: Proof for Loans

Verification tool. Wages earned year to date meaning provides proof for loans.

What Does YTD Stand For on a Payslip? Payroll Context

Stub specific. What does YTD stand for on a payslip in payroll context? Yearly sums.

Full Form of YTD in Salary Slip: Essential Acronym

Core term. Full form of YTD in salary slip as essential yearly tracker.

Get Started Now

Order your customized, accurate, and professional paystubs today with SRS Financials — where attention to detail meets credibility.