At SRS Financials, we provide all types of financial services such as tax preparation, bookkeeping, payroll, business consulting, and financial planning. If you made a mistake on your tax return, you don’t need to worry. The IRS gives you a way to fix it using Form 1040-X, also known as the Amended Tax Return. Our team at SRS Financials is here to guide you step by step so you can save money, avoid penalties, and get the refund you deserve.

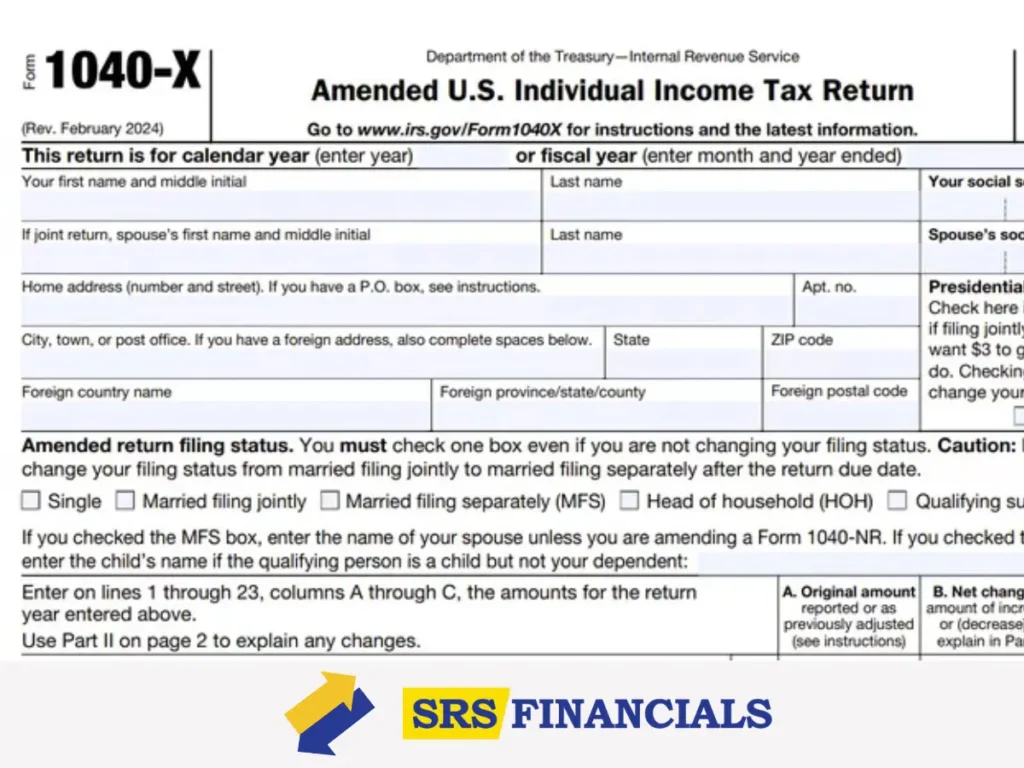

What is IRS Form 1040-X?

1040-X is the official IRS form for amending a tax return. If you filed your taxes and later found an error, this form helps you correct it. Mistakes like the wrong income, missing deductions, or incorrect filing status can all be fixed using this form.

Unlike the regular Form 1040, which is for your first filing, the 1040-X amended return is used only when you want to make changes after submitting your taxes. It ensures the IRS has the correct details so your refund or tax bill is accurate.

When Should You File 1040-X?

You need to file a 1040-X tax amendment when you discover issues in your return. Common reasons include adding a missed W-2, updating dependents, or claiming deductions you forgot.

You should also use it if you chose the wrong filing status or reported incorrect income. Filing a corrected tax return ensures you avoid penalties and get every tax benefit you qualify for.

How to File IRS Form 1040-X

Filing the IRS Form 1040-X can be done in two ways: online filing or paper filing. Online filing is faster, while mailing a paper form may take longer.

To complete it, you need your original return (Form 1040) and supporting documents like W-2s, 1099s, or receipts. Enter the corrected numbers in the right sections, and clearly explain why you are making the change.

Deadlines for 1040-X

The IRS 1040-X deadline is usually within three years of filing your original tax return, or two years from the time you paid the tax — whichever is later. Filing within this time ensures your claim is valid.

If you miss this window, the IRS may not accept your amendment, and you could lose refunds you are owed. That’s why it’s important to act quickly when you notice an error.

Processing Time for 1040-X

The IRS processing time for 1040-X is generally 16 to 20 weeks. Sometimes it can take longer due to heavy IRS backlogs or mailing delays.

If you filed electronically, the processing may be a little faster compared to paper filing. Always keep copies of everything you send to the IRS.

Tracking Your 1040-X Refund Status

After filing, you can check your 1040-X refund status online using the IRS “Where’s My Amended Return?” tool. This service allows you to track if the IRS has received and processed your amendment.

It usually updates once a day, so you don’t need to check constantly. If your refund is delayed, it may mean the IRS is reviewing your documents more closely.

Common Mistakes to Avoid with 1040-X

One common mistake is filing multiple 1040-X forms at once. The IRS processes only one amendment at a time, so wait for the first one to finish before sending another.

Another mistake is forgetting to amend your state taxes. If your federal return changes, your state tax return may also need correction. Always check both.

1040-X vs 1040

The regular Form 1040 is your original tax return, while the Form 1040-X is specifically for amendments. Think of it as a correction tool for fixing mistakes.

If you filed the wrong numbers, you can’t just submit another 1040. You must use 1040-X amended return so the IRS updates their records properly.

Personal Experience

Last year, I made a mistake on my tax return by forgetting to add one of my W-2 forms. At first, I felt stressed and thought I would get into trouble with the IRS. A friend told me about the IRS Form 1040-X, and that it could fix my return without any big problem.

I reached out to SRS Financials, and they helped me prepare the 1040-X amended return. Within a few weeks, my refund amount was corrected, and the IRS accepted my amendment. It felt like a big relief. This taught me that mistakes on taxes are normal, but with the right help, they can be fixed easily.

Conclusion

Form 1040-X is the IRS-approved way to fix mistakes on your taxes. Filing it correctly can save you money, avoid penalties, and ensure you receive the refund you deserve.

At SRS Financials, we provide professional help with tax amendments, payroll, bookkeeping, financial planning, and consulting. If you need expert support with your IRS 1040-X, our team is ready to guide you every step of the way. Contact us today and make your finances stress-free.

Frequently Asked Questions - 1040-X

Can I file 1040-X electronically?

Yes, the IRS now allows electronic filing for most 1040-X returns, making the process faster.

How long does it take to get a refund after filing 1040-X?

It can take up to 20 weeks. The IRS processes amendments slower than regular returns.

Is there a penalty for filing late 1040-X?

If you are owed a refund, there’s no penalty. But if you owe taxes, interest and penalties may apply.

Where do I mail IRS Form 1040-X?

The address depends on your state. Always check the latest IRS instructions before mailing.

What if the IRS rejects my 1040-X?

You can fix the errors and resubmit. If unsure, SRS Financials can help correct it for you.